Master Data Management (MDM) is one of those things you’ve either never heard or have (strong) opinions about.

Let’s dive into why you need to wrestle with it, why it’s known as “the shortest four-letter word in data”, and how to make it better.

Why should you care about MDM?

MDM is an all-industries kind of thing – whether you’re in O&G, retail, utilities, or a maker of knock-off Hot Wheels. When a business needs to have multiple copies of a data type scattered around the company, it’s hard to keep things in sync. MDM is a set of tools and workflows to keep your $#@% aligned.

What kinds of things do people use MDM for in O&G? Most of all, it’s wells. Well data is often scattered across an E&P company – it lives in Accounting, Land, Engineering, Geology, SCADA, and more. Just about every piece of O&G software I’ve ever played with has the concept of a well embedded in it.

But if you want your systems to talk, they have to agree on which well is which.

To have success with data integration, your systems have to share some kind of common identifier. And no, “well name” doesn’t work. <shudders in horror remembering well names with pound signs, abbreviations, extra spacing, etc., etc.> Frankly, API number usually doesn’t work either in our experience. If you’re serious about getting value out of your data, you need to be thinking about “mastering” a few key pieces of data to get the organization agreeing on a single source of truth.

MDM is clearly only three letters, and yet…

So what’s so hard about getting a consistent well list? The simple reason is that what a “well” is varies widely depending on your perspective. Are we talking about wellheads or completions? Accounting Cost Centers or physical wells? Just operated, or do we care about non-operated wells, too? Perhaps the single scariest piece of evidence is that PPDM has a THIRTY-TWO PAGE document defining “What is a well?” Start down the MDM road, and there’s a good chance you’ll spend the next 12-18 months in conference rooms talking about these issues.

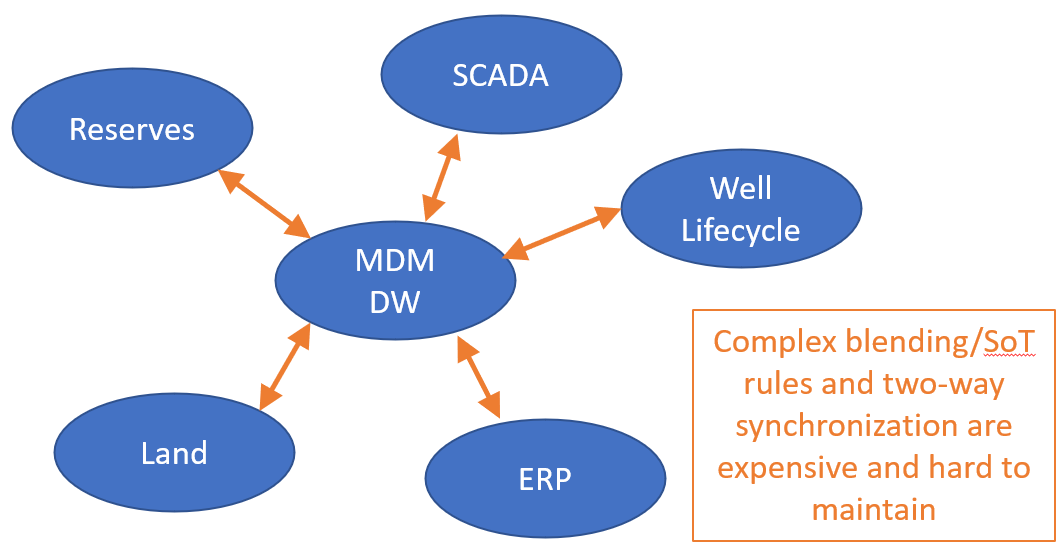

Those months in conference rooms are usually spent hammering out a list of Source of Truth rules for the MDM Data Warehouse (MDM DW), plus detailed workflows around how wells get created in systems around the company. They often struggle through the complexity of parent-child relationships. Even once they are created, maintaining these systems through M&A and drilling programs is expensive and time-consuming. Here’s what conventional MDM looks like:

Looks simple, yet wow it’s hard.

Despite the cost, large companies can benefit enormously from well-implemented MDM systems. They enforce sources of truth, improve data integrity, and make a business run so much smoother. But a conventional MDM implementation is almost always too expensive and time-consuming for smaller E&Ps.

How can MDM be better?

Ahh, the 1980’s…

For smaller E&P’s, conventional MDM is a tough project to justify. But most E&Ps end up evolving towards something that I like to call “MDM Lite”. It’s less weighty but still often gets the job done.

The basic idea is that instead of merging a bunch of data sources like in conventional MDM, we treat a single source as “the Parent”. We don’t merge and smash the way you might in a system like Informatica, Profisee, or EnergyIQ – rather, you just QC the heck out of one system, then ask all other systems to match.

What does this look like in a typical E&P? Often, a reserves system like ARIES or PHDWin will act as “the Parent” – it often gets chosen because the Reserves group finds out about wells pretty early in their lifecycle (when they are still PUDs) and keeps track of them all the way until abandonment. They also frequently integrate with public data, production allocations systems, and ERPs, so reserves engineers and techs are used to storing lots of ID numbers like cost center and API number. Other departments will reference the Reserves dataset, like below:

Ooo, animations!

I love this approach for three reasons:

- Lots and lots of E&P companies are already doing this – it just puts a name to a workflow that many (if not most) small-to-midsize companies have been using for years.

- It reduces application bloat. No need for a big MDM application – this is easy to do with just some basic data warehousing and BI tools that you probably already own.

- It’s quick to implement, but also quick to discard if you end up needing conventional MDM. In Bezos-speak, it’s a two-way door.

For this to work, the Reserves group (or whoever owns the Parent) has to become the “Data Stewards” of this Master Well Header and publish it out to other departments, usually via a Data Warehouse (DW). Then, other departments can bring copies of that data into their own systems – if they see data they disagree with, the solution is to pick up the dang phone, call the “Parent” department, and persuade them to change! Rather than building complex bi-directional data integrations to smash data together like with conventional MDM, you build simpler tools like Data Quality Dashboards that make communication and cooperation as frictionless as possible.

(Note that you can also do MDM lite with another system besides Reserves as Parent, and with other business objects besides Wells. For example, lots of companies use MDM Lite with Vendors using the ERP as the Parent, even though they don’t call it MDM Lite.)

If you’re struggling with getting systems to talk and fighting with your MDM approach (whether conventional or Lite), give us a call. We love talking about this kind of thing and figuring out better ways to use technology to run E&P companies.

We’ll even listen to your four-letter words, and perhaps offer a few of our own.